This post is a response to a question initially posed on Quora, and can also be accessed via “https://www.quora.com/Why-do-people-become-poor-and-broke/answer/Antonio-Amaral-1“

Setting aside the failings of individuals who make bad decisions and cause problems for themselves, because there is always a tiny percentage of people who need more guidance to make better decisions, the vast majority of people suffering in poverty have done everything right with their lives and are still struggling.

A big part of the reason why that happens is that too many people waste their time wallowing in a misanthropic belief that poverty is due to the victims of it being responsible for creating their poverty and that if they just did something different with their lives, they, too, would be among the wealthy in society.

This myth that poverty is a self-imposed sentence is precisely what the thieves in our lives want the people to believe.

This myth that poverty is a self-imposed sentence helps people to believe they won’t become victims of poverty themselves.

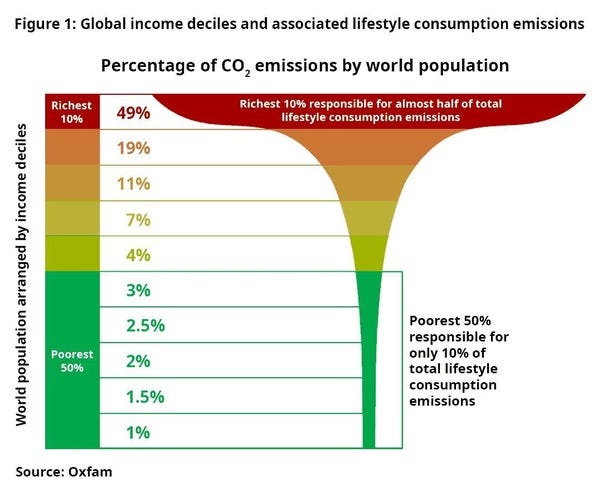

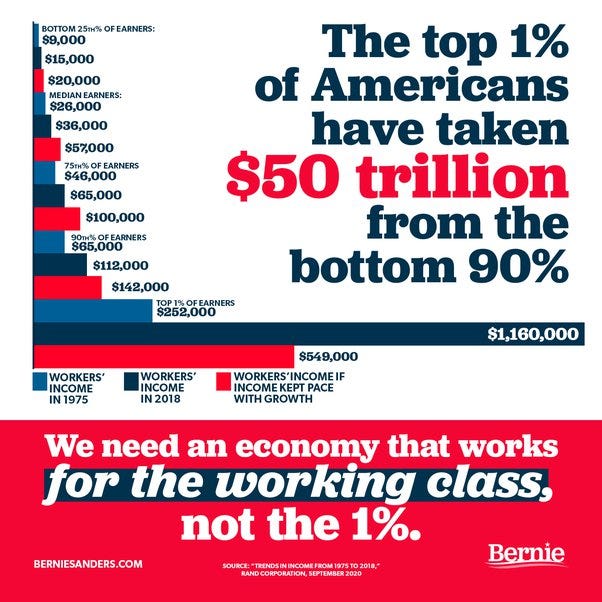

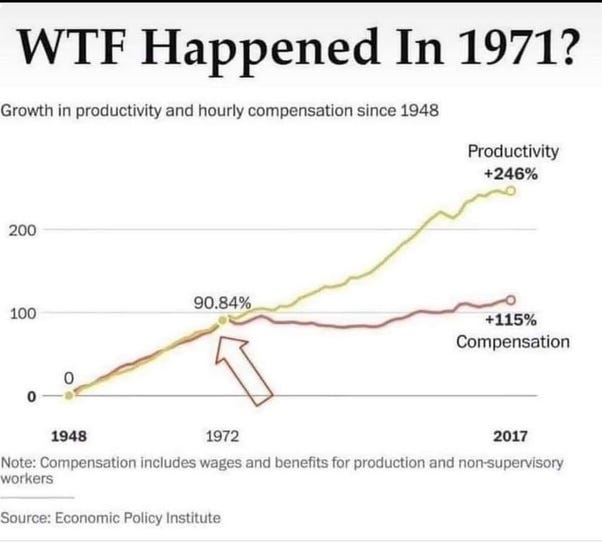

This myth that poverty is a self-imposed sentence overlooks how our culture is geared entirely around impoverishing the majority in favour of the sociopaths who are willing to destroy lives to achieve personal material benefit.

This myth that poverty is a self-imposed sentence is why people become poor and broke because believing this nonsense allows poverty to exist in a post-scarcity world that could easily eradicate poverty overnight — if we could only address the rampant greed corroding the social contract to be the actual cause of poverty instead of shaming the victims suffering unnecessarily in a state of poverty that would not exist if economic justice existed.

There hasn’t been a time in my life where I have not been blamed for the clients who have stiffed me after praising me for doing work they benefited from.

Try to make sense of that.

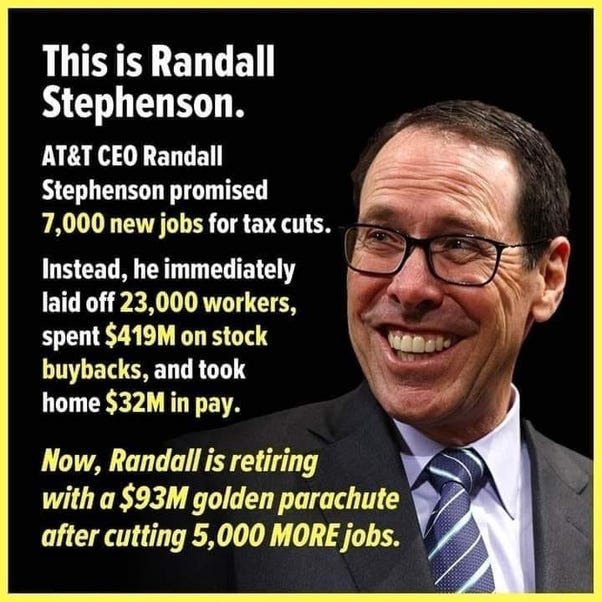

It’s precisely what Donald Trump does when he calls the contractors that worked for him losers. He put thousands of people out of business throughout his life by not paying them for doing work on his behalf, and as far as he is concerned, it’s their fault.

This question embodies a corrupt attitude that pervades society, and it is this attitude that permits poverty to exist.

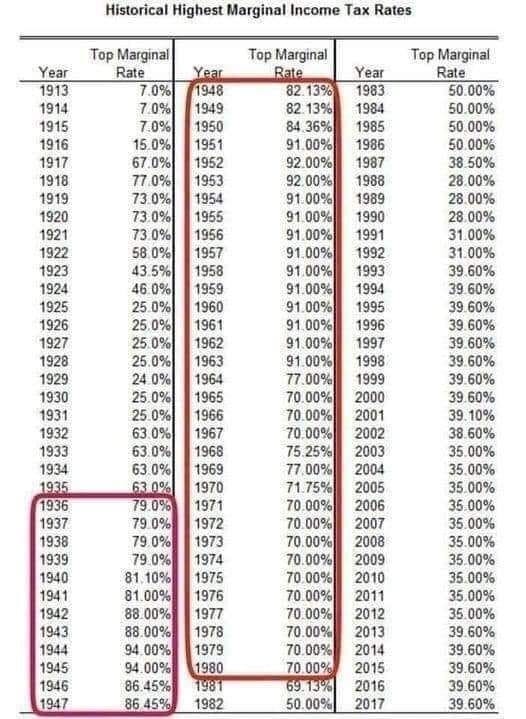

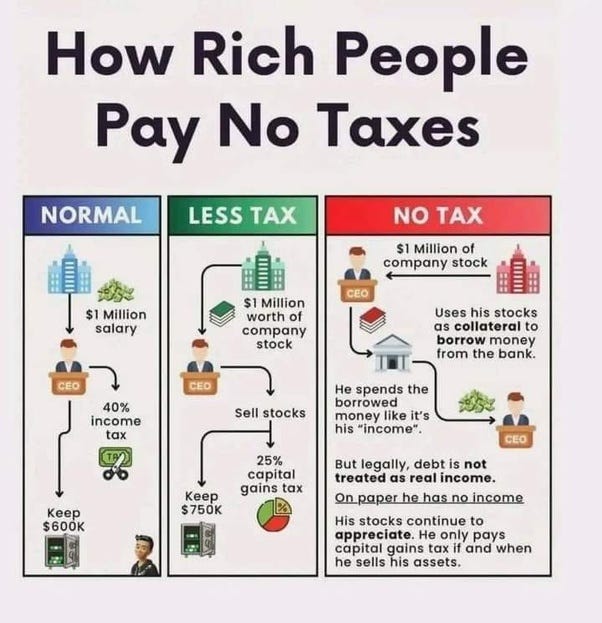

It’s the same attitude that admires how people can avoid paying taxes and envies that ability enough to want it for themselves.

This question enables the attitude of greed to characterize the rot infecting humanity and destroying human civilization because it teaches us to forget that we are all in this together.

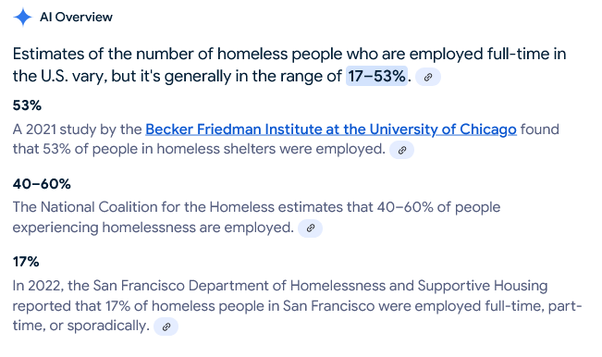

Up to about half the people who are homeless in the U.S. are working full-time jobs.

There are over 25 times more vacant homes in the U.S. than there are homeless people.

Try to make sense of that… and then get pissed off about this: